Retirement may seem like a lifetime away, but time passes so quickly, retirement will be here before you know it. Many people wait until their late 30′s or early 40′s to start thinking about retirement. They unfortunately find out that saving for retirement is going to be a lot harder because they waited so long. When it comes to building a retirement fund, starting early is the best thing you can do. You’ll have more time for your retirement savings to accrue interest and you’ll end up with more money than if you’d waited.

When you start planning for retirement, you have to decide what kind of retired life you want to live. Will you want to have the exact same income that you have now or have a higher income? Will you live in the same area or will you relocate?

Starting with your current income is a good way to think about your retirement income. Typically, you’ll want to sustain the same quality of life as you live now, so you’ll need to have a comparable income to support that lifestyle. There’s absolutely nothing wrong with that. The key is to start putting away money so you’ll be able to have the income you want.

Starting with your current income is a good way to think about your retirement income. Typically, you’ll want to sustain the same quality of life as you live now, so you’ll need to have a comparable income to support that lifestyle. There’s absolutely nothing wrong with that. The key is to start putting away money so you’ll be able to have the income you want.

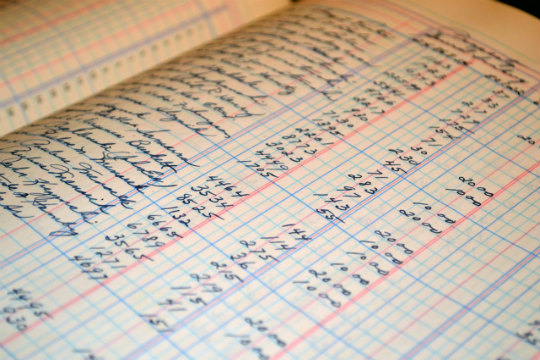

To figure out your retirement savings goal, you can generally multiply your desired income by 25 to come up with the amount you need to save. So, if you want to have a retirement income of $60,000 a year, you’ll need to have $1,500,000 in retirement savings. Using a rule of thumb can give you a ballpark idea of what you need to save, but it’s always better to project your own expenses to come up with a retirement savings goal.

The amount you need to save for retirement can decrease depending on what you expect to receive in social security benefits and any pension you have. Unfortunately, the future of social security is highly unpredictable, so be careful when factoring social security income into your retirement savings.

Your retirement age will have a large influence on the amount you have to save up for retirement. For example, if you plan to retire young, you’ll spend more years living from your retirement savings, so you’ll need to have a larger retirement fund. On the other hand, if you wait later to retire, you’ll need less money in a retirement fund.

Contributing to a 401(k) plan is perhaps the easiest way to save for retirement. Contributions are taken out of your paycheck before taxes and 401(k) contributions are often matched by employers. You can manage your 401(k) plan like any other investment portfolio choosing where your contributions are invested. If you’re not investment-savvy, a financial planner can help you decide how to invest your 401(k) contributions.

Paying off debt while you’re employed will reduce the expenses you have to pay once you’ve retired. Don’t forgo your retirement savings while you pay off your debt. Instead, you should continue to save for retirement, even you save a lower amount, while you reduce your debt. Then, once your debt’s paid off, you can ramp up your retirement savings.…

Car problems – is there anything more frustrating? Whether you just bought the car of your dreams or you’ve been in the same vehicle for longer than you can remember, nobody likes it when they hear that indescribable sound followed by smoke followed by the promise of an outlandish repair bill at the local auto shop that will set you behind for weeks.

Car problems – is there anything more frustrating? Whether you just bought the car of your dreams or you’ve been in the same vehicle for longer than you can remember, nobody likes it when they hear that indescribable sound followed by smoke followed by the promise of an outlandish repair bill at the local auto shop that will set you behind for weeks. Payday loans can be a very appealing and, in many cases, very useful method to solve short term emergency cash needs. However, there are certain drawbacks that you should keep in mind. Payday loans can lead to “lost” pay, high interest rate, fees, penalties and lead you down a path to debt.

Payday loans can be a very appealing and, in many cases, very useful method to solve short term emergency cash needs. However, there are certain drawbacks that you should keep in mind. Payday loans can lead to “lost” pay, high interest rate, fees, penalties and lead you down a path to debt.